Over the last 50 years, there have been two identifiable periods of stagflation: 1973-1975 and 1978-1982. We have entered another period of stagflation, which means the US economy is faced with the dual headwinds of high inflation and slow economic growth. On July 13th, the Consumer Price Index was reported to be 9.1%, which is an extremely high level considering the average US inflation rate from 1980-2022 is 3.25%. Historically, recessions have had a negative impact on M&A activity. However, there is some good news this time around.

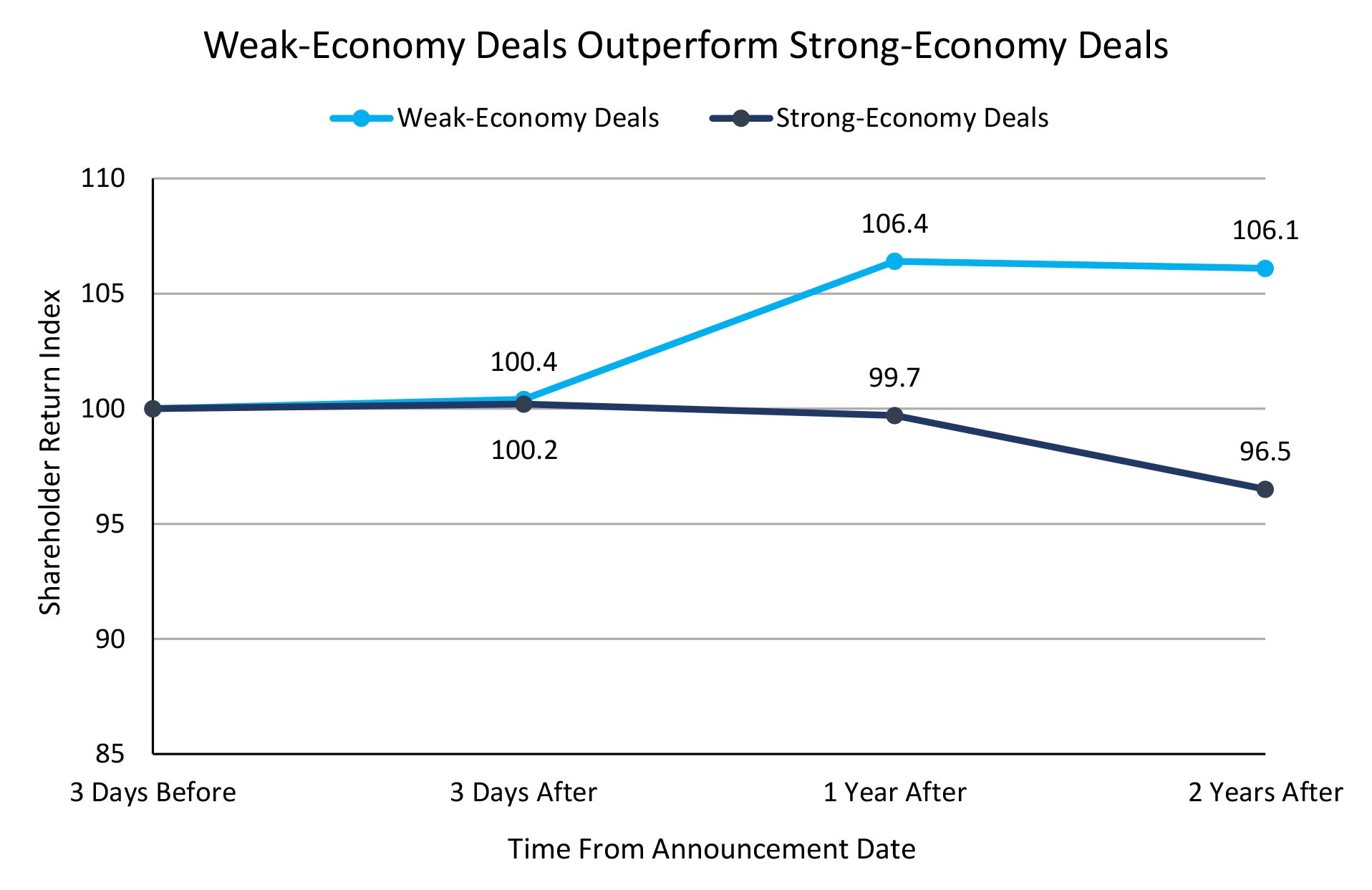

First of all, companies that acquire in a recession historically outperform acquirers in strong economies. According to a study conducted by Boston Consulting Group (BCG), from 1980 to 2018, “weak-economy M&A deals” outperformed “strong-economy M&A deals” by about 670 basis points one year after completion and about 960 basis points two years after completion as the following graph depicts. The strong-economy deals come from years where the GDP growth rate was in the top third of all growth rates during that observation period. The weak-economy deals come from years where the GDP growth rate was in the bottom third. The graph measures the total shareholder return index of deals three days before the announcement date, three days after the announcement date, 1 year after, and 2 years after the announcement date. These numbers were calculated from about 10,000 M&A transactions with public buyers across all industries with deal values greater than $250MM.

Source: BCG “Dealmakers Do Well in Downturns” 2019

Source: BCG “Dealmakers Do Well in Downturns” 2019

The second piece of good news is that infrequent acquirers perform better when they acquire in a recession. According to BCG again, infrequent acquirers (defined as acquiring three or fewer companies in the 1980 – 2018 period of BCG’s data set) statistically lose a significant amount of value, -13.8% of relative total shareholder return (RTSR), two years after acquisitions are made in non-recessionary economic cycles. However, when the economy is down as a transaction is consummated, the two-year RTSR is a positive 1.4% for infrequent acquirers’ transactions. Watermark believes this is due to two reasons.

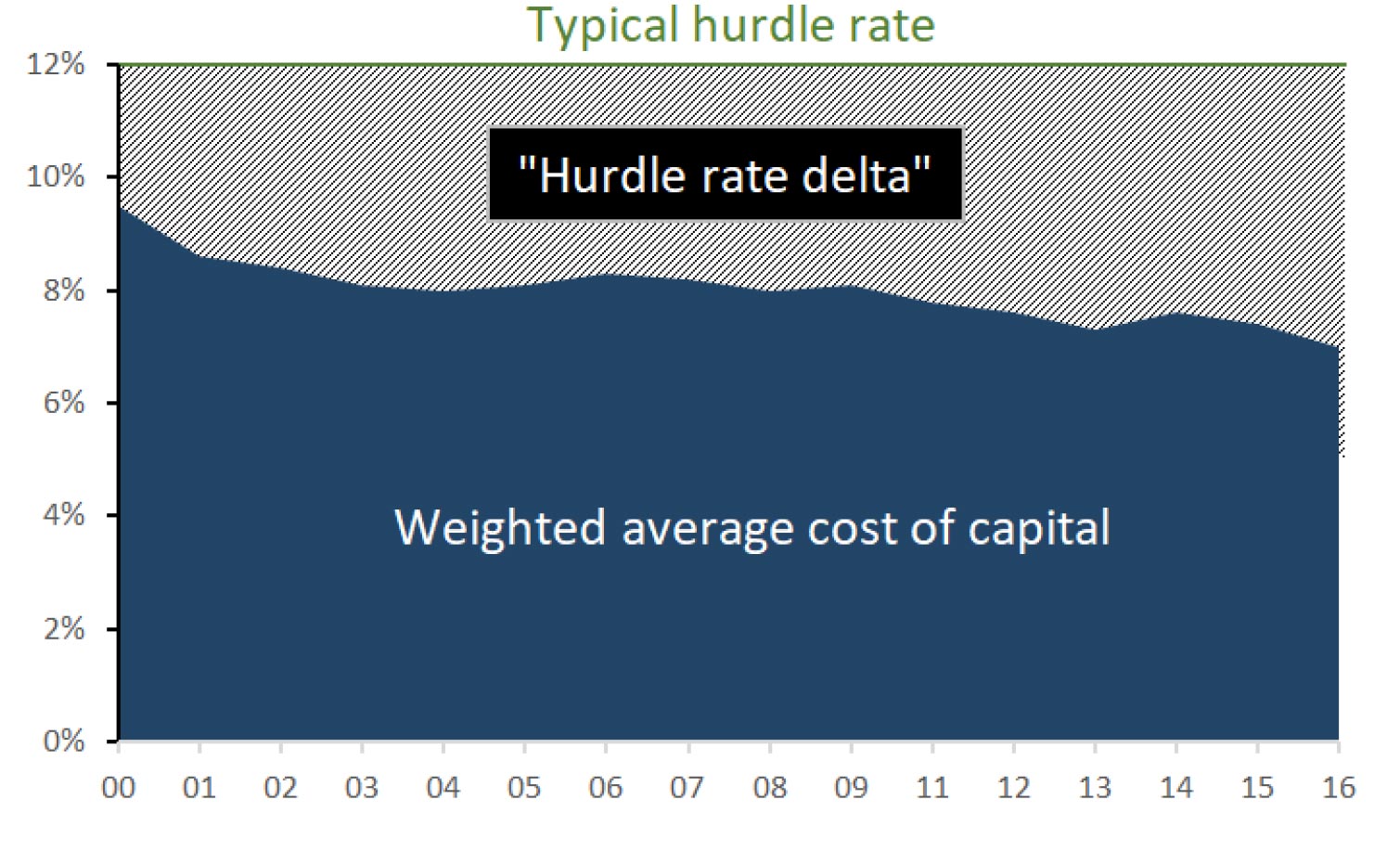

First, acquirers can increase odds of ROI capture above a hurdle rate because selling companies often have lower valuations in a recession due to a combination of lowered present and projected Free Cash Flows combined with elevated Weighted Average Costs of Capital. (See Watermark Wire titled “The Significance of Hurdle Rates, Cost of Capital, and Valuations for Those Exiting Business Ownership”). A hurdle rate (green line in graph below) is a minimum rate of return that an acquirer expects to earn from an acquisition, and it should be greater than the cost of capital for the target’s business. In order to create financial value from an acquisition, management has to conclude that there is an attractive ROI above any hurdle rate.

Said another way, in recessions, many companies cannot keep operating at the levels they want to or that they did in strong economic conditions. This will drag down their valuations, and if they are looking to sell, they could potentially be acquired at a lower valuation. This will increase the probability of an acquirer capturing significant ROI above a stated hurdle rate.

Secondly, in recessions, people typically don’t move around as much from employer to employer. Therefore, staff defections at the target company will be reduced, at least for a prolonged period of time. Thus, a major stumbling block to integration success is mitigated. HR integration has a huge influence on overall M&A success, so if the target company’s management and employees are motivated to stay on board after being acquired and perform at high levels, the acquirer undoubtedly benefits.

Most companies will be looking to “lay low” during this upcoming period of stagflation instead of pursuing acquisitions, but based on the information in this article, it could be wise for companies to think counterintuitively. What steps should you take?

- Evaluate your core business and its ability to withstand a recession that could last 12-18 months.

- Revisit the composition of internal and external resources, acknowledging that missteps often occur in due diligence and integration planning/execution. Under-resourcing or overestimating your internal team’s competencies in these areas can result in risking ROI from your acquisitions.

- Revisit assumptions about which markets you had considered most likely to use M&A to grow. Are your assumptions about those markets still valid?

- Revisit your target list. Do you have enough targets? Often, we find that buyers have a short list of 20-40 targets when in fact they should be considering 50-100+ per end market.

- Design unique ways to approach top prospect targets. This is often where acquirers stumble, costing a loss of time and inefficiencies that keep a motivated acquirer from being able to move into a transaction phase with a motivated seller.

Watermark Advisors, a 20-year-old FINRA member M&A advisory firm, serves clients in all three phases of M&A: Preparation Phase, Transaction Phase, & Integration Phase through a unique approach called “The M&A Bridge.” If you are contemplating an M&A transaction, please contact Hagen Rogers, Executive Managing Director at 864-527-5960 to learn more about Watermark’s unique collaborative, comprehensive approach to M&A services.