The capital gains tax has been a topic of debate for many years, as both individuals and business owners must take these one-time taxes into account when exiting investments.

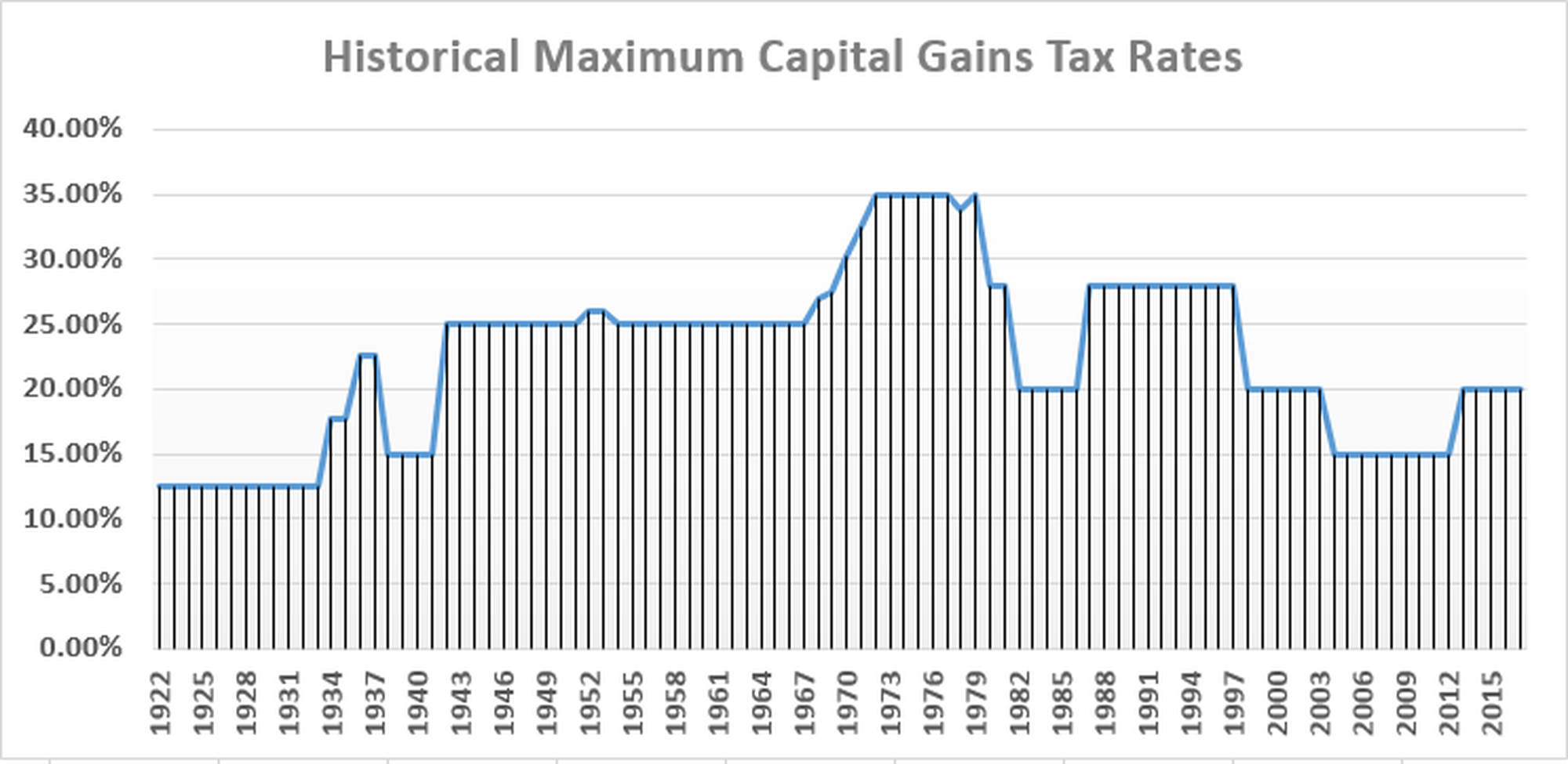

Among other tax hikes currently proposed by the Biden Administration, the proposed Federal long-term capital gains hike under consideration for assets sold greater than $1MM is to raise it from 20% to over 43.4% for those with one-time gains. The actual rate proposed is 39.6% but an Obama surcharge of 3.8% takes the rate to 43.4%. When you then add states’ average top capital gains tax rates on top of federal, total long-term capital gains taxes will push up to 48.6% on average for investors. This would be the highest rate ever recorded, and the highest among OECD countries. This looming tax hike has already motivated a flurry of M&A activity in 2021 as owners rush to sell their businesses in hopes that any tax hike would not take effect until January 2022. Short-term investments are held less than a year while long-term investments are held over a year.

How would the doubling of capital gains tax rates affect supply and demand for M&A? It is logical to conclude that the supply of M&A will fall as owners wait out a potential administration change. The question is how much of a supply-demand imbalance would this create?

A June 2020 article may offer clues. In “Taxing Away M&A: Capital Gains Taxation and Acquisition Activity” in European Economic Review, 5 contributing authors concluded that capital gains taxation distorts the M&A market by imposing a cost to sellers. The research is based on an analysis of 29,546 M&A transactions in North America, Asia and Europe over the period from 2002 to 2013.

A “lock-in effect” materializes whereby the seller holds on to shares vs. selling due to increasing levels of a purchase price lost to taxes vs. holding onto the company and growing shareholder value. This “lock-in effect” increases a premium paid to a seller to achieve a fair market value that motivates that seller to go through with a sale. Therefore, at least in some circumstances, the seller is able to convince the buyer to pay an additional premium to get the M&A closed. However, this additional premium is not always guaranteed. Therefore, more and more transactions simply won’t reach an agreement.

The conclusion of the article’s research is that for every one percent increase in the capital gains tax rate, there is a corresponding 1% drop in annual M&A activity. Further, capital gains tax rate hikes not only negatively affect the M&A market in terms of lowering closed acquisition volume, but it also affects the location of M&As. All else being equal, acquirers favor conducting M&As in countries with lower capital gains tax rates because it faces a lower seller reservation price there.

A supply-demand imbalance from a capital gains tax hike would further exaggerate what most know in the industry, there are fewer sellers than capital available for acquisitions.

As can be seen by the graph below, US capital gains tax rates have ranged widely over the last 100 years, peaking in the early seventies. Since then, they have steadily declined.

US Long Term Federal Capital Gains Taxes 1922-Present

source: For Best Advice

As of July 2021, the tax hikes have not been passed by Congress.

Sources: Tax Foundation, Bloomberg Tax, PwC, European Economic Review

Want To Know More?

To learn more about our services, please complete the form.