Lagging Economic Indicators

Real GDP growth over the last four quarters has increased 2.9%, bolstered by exceptionally strong growth in the third quarter of 2023. The value added of private-goods producing and private-services producing industries increased 10.2% and 4.1%, respectively, while government increased the slowest at 2%. However, projections suggest a notable deceleration in real GDP growth for 2024, according to the Federal Reserve Bank of St. Louis. They forecast real GDP growth to fall from 1.6% to 1.3% in 2024 while JPMorgan only forecasts a 0.7% rate of expansion. Both forecasts factor in slowing growth in the major components of real GDP.

Growth in real personal consumption expenditures (PCE), the largest component of real GDP, is projected to slow from 2.5% to 1.6%.

Growth in real personal consumption expenditures (PCE), the largest component of real GDP, is projected to slow from 2.5% to 1.6%. 2023 saw many upside surprises in real GDP driven by strong real PCE performance, so as this component faces headwinds it is likely we will see slower real GDP growth.[1] Net exports are also expected to negatively contribute to real GDP in 2024 despite positively contributing in 2023. This is due to projections from the International Monetary Fund showing somewhat slower world output growth in 2024.

A slight increase in the unemployment rate is forecasted into 2024 real GDP estimates, contributing to the below-trend real GDP growth.

A slight increase in the unemployment rate is also forecasted into 2024 real GDP estimates, contributing to the below-trend real GDP growth. According to the Federal Reserve Bank of St. Louis, “historically, a 1 percent decrease in GDP has been associated with a slightly less than 2-percentage-point increase in the unemployment rate,” which is otherwise known as Okun’s Law.[2] 2024 forecasts of real GDP growth, unemployment rate, and other key lagging indicators are included in the table below.

Lagging Economic Indicators as of November 2023

| Real GDP Growth | Unemployment Rate | Consumer Price Index % Change | Consumer Confidence Index | Federal Funds Rates | |

|---|---|---|---|---|---|

| 2021 Average | 5.9% | 5.4% | 4.7% | 99.98 | 0.08% |

| 2022 Average | 0.7% | 3.6% | 8.0% | 96.75 | 1.68% |

| 2023 Average | 1.6% | 3.7% | 3.2% | 97.33 | 4.58% |

| 2024 Projected | 1.3% | 4.2% | 2.6% | N/A | 4.60% |

Several factors could push unemployment to 4% by the end of 2024.

Although the labor market continues to outperform expectations, the expected slowdown in real GDP growth for 2024 could result in a reduction in the pace of job gains, forecasted to be slightly below 100,000 per month. This contributes to forecasts of a slight increase in the unemployment rate.[3] Payroll growth is slowing as well, reducing momentum in the job market. These factors combined could push unemployment to 4% by the end of 2024.[4] However, each industry is impacted differently by unemployment. As of December 2023, agriculture and related private wage and salary workers were experiencing the highest rate of unemployment at 7%, while government workers were experiencing the lowest at 1.5%.[5]

Inflation stands as a persistent challenge for the global economy. The Federal Reserve Bank of St. Louis projects a continued decline in both headline and core PCE price index inflation. According to the median forecasts from FOMC participants, inflation is anticipated to drop below 3% in 2024. The U.S. economy shows signs of declining inflation, with the 12-month percent change in the all-items CPI dropping to 3.2% in October from a peak of 9.1% in June 2022. The CPI was at 3.7% as of December 2023. Factors such as more restrictive monetary policy, a convergence toward the Federal Reserve’s 2% target, and balancing aggregate supply and demand have played roles in this decline.

“Getting inflation from 9%-3% was the easy part but getting it from 3% to the Fed’s 2% target will be far more challenging.” -Stephanie Pomboy of MacroMavens

Despite recent improvements, inflation remains above the Fed’s 2% target. Stephanie Pomboy, founder of the economic research firm MacroMavens, recently noted that inflation may play out differently than the markets perceive. She notes that getting inflation from 9%-3% was the easy part but getting it from 3% to the Fed’s 2% target will be far more challenging. According to Pomboy, “we’ve had a huge inventory liquidation cycle that was the main driver of falling inflation, but this cycle is largely complete,” so now the question is raised about whether businesses start to rebuild that inventory or not. The disinflationary impact from this event is over and now it may become more of an inflationary force if companies choose to rebuild inventory in part because of new supply chain dysfunction due to geopolitics in the Middle East and Eastern Europe. Because of this, the ability the Fed has to cut rates is going to be put into question.[6]

Analysis done by JPMorgan suggests an end to the rate hiking cycle.

Analysis done by JPMorgan suggests an end to the rate hiking cycle, anticipating a hold at 5.25-5.5% until mid-2024 before cutting rates by 25 basis points at each meeting beginning in June. This brings the target rate down to the range of 4-4.25% by the end of 2024. The projection is contingent on ongoing inflation moderation. However, there are many differing viewpoints on whether the Fed will be as aggressive when cutting rates as the markets seem to believe. Some analysts forecast a reduction of only 50 basis points, assuming the Fed may not pursue such an aggressive approach. JPMorgan also forecasts that quantitative tightening will continue throughout 2024 despite the FOMC’s indication they hope to normalize policy. This policy entails the removal of $1 trillion from the economy over the next year at a rate of $95 billion per month.

Geopolitics

In 2024, the geopolitical landscape will face heightened strain with over 50 major elections taking place worldwide. Notably, four elections—the United States presidential race, the Indian prime minister reelection, the recent Taiwanese election, and the Indonesian election—have the potential for global impacts, shaping the policies and priorities of some of the world’s largest democracies.[7]

The repercussions of these elections on geopolitics and global business could be extensive, urging business leaders to vigilantly monitor their outcomes.

The repercussions of these elections on geopolitics and global business could be extensive, urging business leaders to vigilantly monitor their outcomes. According to Reuters, monitoring these events is crucial for managing risks and seizing opportunities arising from the changes in political landscapes.

Additionally, JPMorgan highlights the importance of keeping geopolitical risks at the forefront of considerations in 2024. Ongoing uncertainties and risks include various geopolitical tensions such as trade conflicts with China, the Russia-Ukraine war, and conflicts in the Middle East. Despite the limited direct impact on the U.S. economy from these tensions, JPMorgan points to the primary concern of a potential supply shock in critical commodities or goods like energy, food, or semiconductors, which could lead to substantial market disruptions.

“2024 could be a year of a ‘black swan’ event.” – Catherine Herridge of CBS News

Catherine Herridge, a Senior Investigative Correspondent for CBS News, notes that 2024 could be a year of a “black swan” event. According to Herridge, “this is a national security event with high impact that’s very hard to predict.” The economic implication of rising tensions, heightened threat levels, and increasing division within the country is that it creates a potential vulnerability for foreign adversaries to exploit, which could have negative consequences on the nation’s economic stability and security.[8]

Ballooning U.S. Debt

A significant concern is the escalating national debt. Washington recorded a budget deficit of $1.7 trillion in the fiscal year of 2023, reflecting a 23% increase from the previous year.

The U.S. economy confronts a grave situation, as warned by Dr. Dave Brat, economist and Dean of Liberty University’s business school. Dr. Brat associates the economic challenges with the government’s overreach into free markets, indicating possible negative consequences for the country. A significant concern is the escalating national debt. Washington recorded a budget deficit of $1.7 trillion in the fiscal year of 2023, reflecting a 23% increase from the previous year. His projections indicate significant debt challenges, with the potential recycling of $8 trillion in debt by the U.S. government, leading to staggering interest payments if rates rise from current levels.

According to Brat’s calculations, a 5% interest rate could result in $2.5 trillion per year in interest payments on the projected $50 trillion debt in ten years, significantly impacting the national budget. Dr. Brat warns that over half of the national budget could potentially be allocated to interest payments alone, surpassing three times the defense budget.

The Biden administration’s pursuit of public programs adds to the complexity of the economic landscape. The programs include the $1.9 trillion American Rescue Plan Act, the $2 trillion Build Back Better Plan for infrastructure, and the estimated $1.2 trillion Biden’s Inflation Reduction Act. This amount of spending raises questions about long-term fiscal sustainability and the balance between economic stimulus and potential consequences.[9]

Yield Curve

Historically, the yield curve has been a reliable signal for impending economic downturns, reflecting the expectation that the Fed will cut rates in response to slowing inflation and a weakening economy.

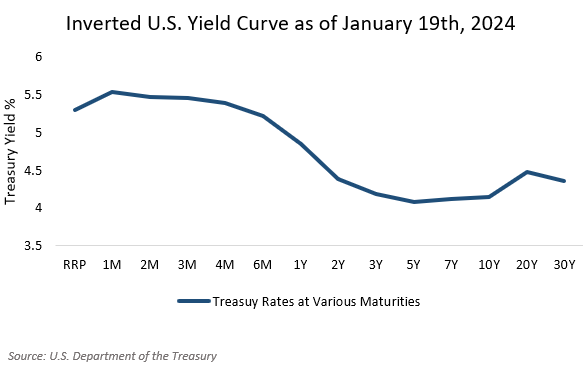

The current state of the yield curve serves as an indicator for economic trends and potential recessions. Historically, the yield curve has been a reliable signal for impending economic downturns, reflecting the expectation that the Fed will cut rates in response to slowing inflation and a weakening economy.

The current curve, which is the least inverted since November of 2023, suggests we are in the early stages of a “bull steepener.”

Since 2022, the yield curve has taken on an inverted shape, with yields on long-term Treasuries falling below those on shorter-term ones. The current curve, which is the least inverted since November of 2023, suggests we are in the early stages of a “bull steepener.” This implies that the 2-year yield is declining faster than the 10-year yield, causing the curve to steepen. While the curve is still inverted, investors are increasingly purchasing the long end of the curve, leading to a reduction in inversion. A bull steepener often indicates investor expectations of decreased inflation, a cooling economy, and potential rate cuts.

Outlook for 2024

According to the Survey of Professional Forecasters, it is estimated that there is roughly a 40% probability of negative real GDP growth in the first half of 2024 and a 36% probability in the second half, surpassing the historical average recession probability of approximately 15%.

The likelihood of a recession in 2024 has seen a reduction in initial forecasts, yet the lingering risk remains. According to the Survey of Professional Forecasters, it is estimated that there is roughly a 40% probability of negative real GDP growth in the first half of 2024 and a 36% probability in the second half, surpassing the historical average recession probability of approximately 15%. Several factors contribute to the risk of a recession, including concerns about the effectiveness of the Fed’s current monetary policy in achieving their 2% inflation target. Fed Chair Jerome Powell expressed uncertainty about achieving this target, suggesting that further policy rate hikes might further slow real GDP growth in 2024. The projection for inflation in 2024 is approximately 2.6%, aligning with the potential for a soft landing for the economy, according to the Federal Reserve Bank of St. Louis. Senior Fed officials emphasize the continued need for vigilance to return inflation to the target within a reasonable timeframe.

[1] “GDP by Industry,” Bureau of Economic Analysis. 2023, www.bea.gov.

[2] Kevin Kliesen, “Slower GDP Growth and Falling Inflation in U.S. Economic Outlook for 2024,” Federal Reserve Bank of St. Louis. 2023, www.stlouisfed.org.

[3] Bryce Engelland, “Geopolitical & Economic Outlook 2024: Democracy and the Splintering Economy,” Reuters. 2023, www.thomsonreuters.com.

[4] Ginger Chambless, “2024 Economic Outlook: 10 Considerations for the US Economy,” JPMorgan Chase. 2023, www.jpmorgan.com

[5] “Unemployment rate in the United States in December 2023, by industry and class of worker,” Statistica. 2024, www.statistica.com.

[6] Stephanie Pomboy on Mornings with Maria. 2024, www.foxbusiness.com.

[7] Bryce Engelland, “Geopolitical & economic outlook 2024: Democracy and the splintering economy,” Thomson Reuters. 2023, www.thomsonreuters.com.

[8] Samantha Chang, “CBS Reporter Predicts ‘Black Swan’ Event in 2024: ‘Fertile Ground for Our Adversaries’,” MSN. 2023, www.msn.com.

[9] Jack Walters, “’Not Sustainable!’ US Economy Faces ‘Bleak’ Year as Expert Warns Untold Damage Looms,” GB News. 2023, www.gbnews.com.